Shrinkage in retail comes in many forms; thefts, markdowns, and human error all eat into profits. Grocers, however, put out a full-scale buffet, when the perishability of products is taken into account. Historically, grocers have some of the lowest margins at 2.5%.

Those low margins are colliding head-on with a massive shift in consumer taste preferences for more fresh food—piling up the plate when it comes to opportunities for additional shrink. A 2018 survey found that 60% of retailers are stocking more refrigerated and fresh products than in the past, and 48% are expanding their refrigerated section to meet demand.

Add in declining grocery profit margins, and it’s clear that getting a handle on this issue may be the difference between surviving and thriving in the competitive grocery landscape.

Identify the Root Causes of the Problem

As with any other type of shrinkage in retail, each grocer will have its own issues and root causes. Broadly speaking, retailers tend to see shoplifting as the biggest source of shrink, with six of the nine most frequently boosted items found in grocery stores. Yet fresh food spoilage and other problems play a significant role.

For grocers, combating shrinkage in retail requires insight into the actual cause of the problem. It may be something other than theft. Perhaps it is simply an accounting or paperwork error, known as “paper shrink.” As Mark Sullivan, a former accounting forensic manager at Deloitte, put it: “If the company cannot identify its paper shrink, then it does not have an accurate handle on its real shrink.”

Identifying the causes of shrink may mean diving down to the store level. Dan Faketty, vice president of loss prevention for Southeastern Grocers, notes how he used data and detective work to identify shrink sources at one store. The store in question had losses of about three or four times the corporate average. As Faketty observed:

“Nothing is more eye-opening than visiting stores, especially for the first time. Within an hour or two, one immediately gets a sense of how a store is run, the controls (if any) that are in place, and how actively engaged the staff is or isn’t in managing retail shrink and other loss prevention processes.”

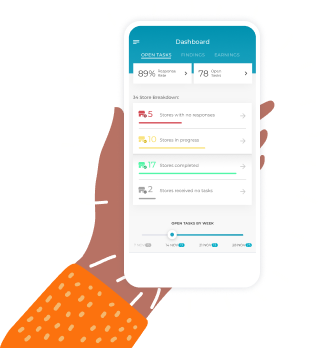

Thanks to technology, much of this insight is available without an in-person visit. Predictive analytics tools can provide timely insight on what’s not moving from store shelves. CB4’s machine learning tool uses POS data to uncover persistent in-store operational issues that hurt your bottom line and, when they affect fresh foods, contribute to shrink.

If items with short shelf lives aren’t properly displayed on your floor, they’ll expire before they sell to their potential. With over 40,000 SKUs—more and more of which are fresh—in your average grocery store, the potential for loss is great. Incorrect signage, products left in back stock, or products hidden behind others are common contributors to shrinkage that also eat into your profits.

But how do store teams know when in-store operational issues are affecting important SKUs? Items in high local demand don’t always appear on your chain-wide bestsellers list and are liable to go unchecked. And even your most eagle-eyed store manager can’t catch every execution problem on the floor.

In a recent instance, CB4 sent an alert to a grocery store manager to check on fresh gourmet mussels. The item was persistently underselling at one store in our client’s chain. When the manager went to check on the mussels, he discovered that the problem was due to an incorrect price label. The seafood display case had two overlapping price tags—$7.99 and $5.99—which created confusion. Mussels were the lesser price, but customers believed they were overpriced due to the signage and left them forsaken in the case.

The issue was fixed and sales recovered. A source of shrink was eliminated. Seafood departments are known to have the greatest health risk, the greatest product shrinkage, and the shortest shelf life of all supermarket products. The store manager took the opportunity to further train his staff on proper labeling. Bolstered by CB4, he continued to look out for the SKU as a source of revenue and of potential shrink.

Revamp Your Ordering System

As perishable items sit on grocery shelves, each passing day increases the likelihood of shrink. Need proof? Just watch that banana ripen. Sometimes the problem isn’t an in-store execution problem, but an excess of inventory or a suboptimal pricing strategy.

For Roche Brothers, a small Massachusetts chain, an understanding of its daily bread made the difference. The company noted that its most popular items had some of the highest shrink rates. A popular fresh dinner roll often was tossed at the end of the day, because bakery managers overestimated demand. Two sizes of fresh baked breads included a high level of waste. The larger size was being thrown out at the end of the day while the smaller size was a sellout. While not technically “shrink,” a sell-out indicates a missed opportunity for a sale—and a disappointed customer.

Fact-based ordering can take the department manager’s guesswork out of the equation. Sophisticated ordering systems take into consideration current stock, anticipated sales based on the day of the week, store promotions, and other factors. The end result is a trifecta of reduced shrink, increased availability, and fresher products.

Dynamic pricing—a strategy employed by online retailers to change prices multiple times throughout the day based on certain factors—maximizes movement of perishable products. For instance, a warm day might mean markdowns on hot soups. A slow afternoon might cause rotisserie chickens to see an unplanned price break. Retailers have relied on a manager’s discretion to employ this technique in the past, but POS data and predictive analytics software can automate this process.

Train Your Floor Teams

Relying on human judgment is not just the standard operating procedure for ordering and markdowns. Grocers allow department managers to determine the amount of shelf space per product or category. Insight into what is selling—and what is spoiled—can guide the department manager in allocating space. But the responsibility is not the manager’s alone. Properly trained employees can make a sizeable difference in the department’s success reducing shrinkage in retail. One European chain found a 20% reduction in shrink levels by simply training employees that items that mature at different rates—like stable carrots and fragile peaches—should not be stocked on the same shelf.

All facets of shrinkage in retail can be positively influenced by well-trained staff who interact with customers. “The best shoplifting prevention method hasn’t changed over the years,” says Chris E. McGoey, president of McGoey Security Consulting, Los Angeles. “Provide good customer service. Greet people as they come into the store and look them in the eye. Offer to help when person is wandering aimlessly.”

A heightened presence means employees can be available to assist customers while reducing shoplifting. They may be alerted to problems by a secret code announced over the loud speaker. An added bonus: A tidy store makes it easier for shoppers to find what they need, improving the customer experience.

Mind Your Self-Service Checkouts

OK, so we have insight into what needs to be on the shelves, and we have a well-trained staff looking for shoplifting. So why is shrinkage in retail still occurring? In some cases, it may just be walking out the door. Self-service checkouts can be a blessing and a curse. They boost business, yes. They increase consumer perception of your store and they reduce workforce.

But they also provide an easy opportunity for theft. One of the most widely used techniques is ringing up an expensive item with a code for a cheaper alternative. The organic avocado may cost twice as much but doesn’t look all that different than the conventional one. Shoppers may peel stickers off cheaper items and place them over more expensive versions, like a meat label for a pound of on-sale ground beef swapped for an equal-size steak.

These techniques are not unique. A 2018 article in The Atlantic found that 20% of shoppers admit that they’ve done this, according to an anonymous online questionnaire. Some chains have scaled back or removed self-checkout altogether. Technology plays a role in the solution, with video analytics used to monitor self-checkout areas. Staffing and training also can help, but additional staff to oversee the self-checkout negates the main benefit.

Meticulousness and Technology Shrink Shrink

Successfully reducing shrinkage in retail requires a careful balance of ingredients. Corporate must act as chef, enacting policies and employing techniques in each location, each product, and each supplier in the chain. Machine learning technology is a key ingredient in fine-tuning your ordering system and correcting in-store execution problems. Add a dash of empowerment, by training department managers and cashiers. Keep an eye on the self-service checkouts to ensure that you don’t get burned. The end result may not be a recipe to make Julia Child proud, but it might just keep your grocery store from being eaten by shrink.

Learn how CB4’s machine learning tool helps brick-and-mortar stores reduce shrinkage in retail, meet local demand, and solve in-store execution problems by crunching POS data to turn insights into action.

Related:

The Future of Grocery Technology: Level Up or get Left Behind

How Cutting-Edge Technology is Helping Prevent C-Store Theft

How CB4 Improves Communication in Retail Between Corporate & Store Teams