2018 was simultaneously record-setting and full of change for c-stores. In-store sales reached a record high of $242.2 billion, and total sales went up by nearly 9 percent, driven mostly by increasing fuel costs. Despite this, growth in convenience retail is slow. Consider that in-store sales only increased 1.7 percent in 2018, attributable to declines in both new customers and automobile usage.

Additional change was brought on by industry consolidation as 7-Eleven and Alimentation Couche-Tard combined to add over 1,800 sites via acquisitions. Mid-tier stores weren’t immune to the acquisition fever either. For instance, Giant Eagle absorbed Ricker Oil’s 56-store group in late 2018. All told, there are now 5% fewer independent c-store chains than there were in 2017.

Stores will need to adjust as the industry and trends that fuel growth evolve. By way of a multitude of new stores and new retail technologies, consumers have a diverse array of choice when it comes to c-stores. Does your store have what it takes to be the modern convenience store? Here are 7 things you’ll need to evolve alongside your customers.

1. A Restroom that Wows

A recent study done by Chicago-based consulting firm Balvor LLC discovered that 10% of all customers walking into a c-store used a restroom, but that using the restroom was not the primary purpose of their trip inside the store. Restrooms are a bit of a paradox: having clean restrooms won’t pull customers through your doors like a good promotion will, but it a poorly-kept restroom can certainly hasten their exit. Customers associate a clean restroom with the overall quality of a store. Therefore, in a c-store market where freshly prepared foods are increasingly in vogue, the ability to exude cleanliness and quality is of the utmost importance.

As revealed in GasBuddy’s most recent summer travel survey, 37% of drivers list being unsure of where to stop for a clean restroom as one of their worst driving fears. Buc-ee’s wants customers to know it’s here to calm those fears. To that end, the chain took the restroom experience to a new level with Tooshlights. When a customer ventures inside their restrooms, Tooshlights are Bucc-ee’s way of saying ‘don’t worry, we’ve got you’. Tooshlights provide a light outside stall doors to signal whether they are available or occupied, thus mitigating any opportunities for awkward bathroom encounters. With innovations like these in mind, is it any coincidence that Buc-ee’s was best rest stop in America by Bon Appetit?

Despite not having Tooshlights, Wawa is also in on the game: their bathrooms were voted as the number two best public bathrooms in the entire United States. Given how crazy shoppers are for both these c-store chains, it’s no coincidence they both prioritize restrooms.

2. A Made-to-Order Food Program

Packaged, prepared meals are no longer enough to differentiate you from your competitors. Despite Sheetz originating the idea of offering fresh, made-to-order food way back in 1986, 2019 is really the concept’s true coming out year.

Wawa and RaceTrac are two retailers who are leading the way with customizable fresh food programs. Not only does Wawa have a vast array of customizable sandwiches, they provide customers with touch screens to order them (and have been doing so since 2002!). Even more exciting, however, is the chain’s foray into health food—they even sell kale and quinoa to appeal to today’s health-conscious consumer.

Doing away with dingy packaging and limp lettuce, RaceTrac Petroleum has also earned the title of modern convenience store. As of late 2018, the chain now operates a deli food counter that features ready-to-order wraps, sandwiches, barista style hot and cold beverages. Striving to be just as much a modern convenience store as Wawa, ordering at RaceTrac’s deli counter is done at an electronic kiosk.

3. A Surcharge-Free ATM

ATMs are big business for cash-dominated c-stores. Cash on hand means a chance to upsell and increase basket size. But convenience shoppers don’t want to spend nearly as much as their store transaction in ATM fees. They might do it once out of necessity, but they probably won’t come back for more.

Recognizing that it shouldn’t cost money to spend money, large chains like 7-Eleven and Wawa have shifted towards surcharge-free ATMs. At more than 8,000 U.S. c-store locations, 7-Eleven now offers surcharge-free ATMs. Wawa goes as far as listing their free ATMs on their corporate website. To find one of these handy ATMs nearby, all one needs to do is head to Wawa’s ultra-convenient store locator.

Whether it’s at ATMs or just banking in general, it’s getting cheaper and cheaper to access your own money—modern convenience stores should be following suit.

4. Digital Signage

As mentioned above, trends change quickly. Not only will you need to stock your stores to reflect these changes, you’ll need to be able to nimbly promote these trends to entice customers to buy. Rather than swap out static promotional material, which is costly and time consuming, modern convenience stores are utilizing digital signage to facilitate greater consumer engagement and greater consumer spending.

Two main ways that digital signage can help increase sales? Upselling and selling tertiary goods. By utilizing digital signage, c-stores can upsell customers into buying a natural add-on to what they’re already purchasing. For instance, those customers pumping gas could be enticed into a car wash, or someone purchasing a sandwich persuaded into adding a bag of chips.

For tertiary goods, digital signage can pique customers’ interest and get them to buy something they hadn’t even thought about before entering your store. Someone who enters your store to buy a beverage is likely going to do so regardless of signage, but having a digital display showing the week’s lottery jackpots could get them to purchase something entirely unrelated.

According to NACS, food service accounts for 22.6% of in-store sales, and this is expected to grow. Furthermore, cars with greater fuel efficiency means fewer trips to the pump. Digital signage is a fantastic way to convert fuel-only customers to in-store buyers and to drive sales towards new products as tobacco sales continue to flag.

5. A Personalized Loyalty App

When it comes to where to shop, the more choice that consumers have, the more difficult it becomes to attract and retain them. As choices proliferate, so too does the competition to stand out. This fight to stand out has raised consumer expectations.

One way to earn loyalty is by implementing an intuitive, alluring, and personalized rewards program. A 2019 report from research firm Beroe notes “growing demand for customizable digital rewards” from consumers. The ultimate modern convenience store, 7-Eleven, has not one but two apps that inspire loyalty—7Rewards for customers to earn, score, and redeem points, and 7Now for customers to get 7-Eleven delivered to their door day or night.

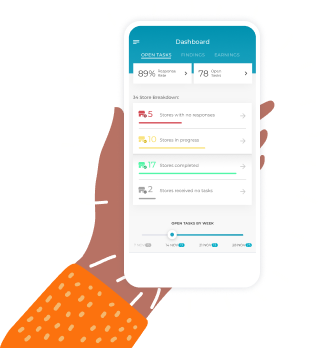

As such, a modern convenience store needs to utilize a digital loyalty app—not only to go the extra mile and reward their best customers for return business, but also to track customer habits and preferences so as to improve their in-store and merchandising experience. Implementation of an effective app can be a perpetual growth and feedback loop. 73% of shoppers who utilize apps will shop more frequently, or even exclusively, at the convenience store when they are a loyalty member. This frequency then garners you more data to improve your store across a variety of customer touch-points.

6. An Enterprising Eye for Unconventional Products

It’s not enough for the modern convenience store to stock the old favorites. Convenience Store News shares findings that 71% of consumers will pay a higher price for food and drink items composed of ingredients they know and trust, and 18% of consumers would go as far as to pay a 75% premium for those same items. According to Grocery Dive, a 2017 survey of U.S. convenience store owners from NACS reveals that almost all retailers cite the addition and/or expansion of healthy items to their stores as a major contributor to their in-store sales increases.

To capitalize on this healthy evolution, Rutter’s, the Pennsylvania-based c-store chain introduced its “No Antibiotics Ever” chicken earlier this Spring. Other retailers, such as Cenex Zip Trip, are innovating by adding CBD to their assortment. Despite the potential regulatory complications, Cenex Zip Trip is poised to capitalize on this up-and-coming product category. Thus, modern convenience store chains are keeping their eyes to the ground and thinking before traditional c-store product silos.

7. A Data-Driven Assortment & Merchandising Strategy

To hone product mix, retailers need to look beyond what transpires inside an individual store to understand broader trends.

Sometimes, these trends are large scale. For instance, the Western region of the US sells significantly fewer cigarettes and tobacco than other regions of the US. On top of that, the category has only experienced 1.1% year-over-year growth versus 10% in salty snacks. To account for this regional preference, c-stores in the Western U.S. need to merchandise their products in such a way that reflects these growth trends. If they don’t, they risk missing out on their largest areas of growth.

While this is a large trend, there are hundreds of smaller trends that affect the way each store needs to conduct business. The businesses and institutions that surround each of your locations–hospitals, schools, gyms, and more–will all leave an imprint on your store’s selling patterns. Modern convenience store operators are eyeing solutions that help them sort through the noise to make data-driven decisions at scale.

CB4 partners with convenience retailers large and small to help them adapt to hyper-local demand patterns and rise to the increasingly complex demands of shoppers at their chain. Ready to learn more? Let’s connect.