For years, retailers have been using analytics and traditional reporting to try to uncover and correct floor execution issues in stores. If you’ve tried using reporting to tackle issues on a store and SKU level, you probably hit some roadblocks on the way.

The biggest challenge is typically accuracy. The reports have to generate alerts that reliably uncover SKUs suffering from operational issues while maintaining a low false positive rate. This means that more often than not, alerts should uncover real operational issue in store that hold back sales of specific SKUs. Without accurate reporting, store associates will very quickly grow skeptical and lose motivation as pencil whipping ensues.

Another point to consider is the blind spot that some retailers have when approaching such a project. There’s often too much emphasis placed on out-of-stocks, to the exclusion of other execution problems that holdback sales. I will share some data to demonstrate that too narrow a focus on out-of-stocks causes retailers to miss other critical issues.

In this short blog article, I’ll touch on these topics and challenges, and also share another obstacle that will probably surprise you (as much as it surprised us).

Obstacle 1: Finding a Solution that Detects Operational Issues in Stores

It’s not easy to know when something is going wrong with a single SKU in a store. To know if a SKU is not meeting its potential sales in a store, you first have to predict that SKU’s “true demand,” i.e. how much it should be selling at a given location.

Traditional retail technologies aren’t able to do this. Relying on what’s sold in the past or what sold at a so-called “similar store” is not enough. If you want to learn more, head over to our white paper about why traditional retail benchmarks fail stores.

If you don’t have a good indication of how much a SKU should be selling at a store, how can you know with real accuracy whether a store is experiencing a problem?

Obstacle 2: Focusing on Out-of-Stocks Exclusively

When traditional technology does detect a SKU that’s truly failing to meet its sales potential, the problem is often attributed to a stock outage—probably a supplier issue or flaw in the retailer’s ordering system.

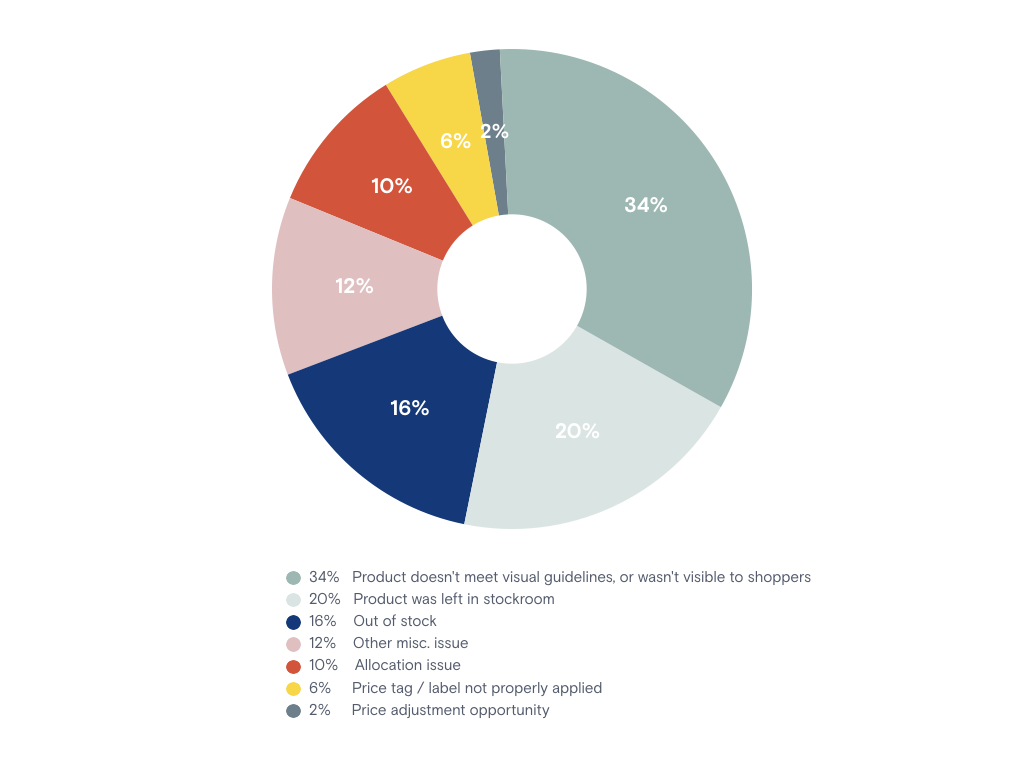

But in the world of brick-and-mortar, out-of-stocks, while pesky, are only a small part of the problem. In fact, depending on the retailer, 5%-25% of the issues CB4’s solution uncovers are due to an inventory-related issue. This includes tens of millions of uncovered operational issues for thousands of stores across North America and Europe.

Here is a chart showing the breakdown of issues we’ve discovered across all of our customers.

Main Reasons Store Managers Identified for SKUs Failing to Meet Sales Potential

It’s clear that focusing only on out-of-stocks could leave a lot of money on the table and a good deal of store-level issues unresolved.

Obstacle 3: Accounting for Your Store Associates’ Different Skillsets

Now we get to the real heart of the problem. Even if you can predict demand for a SKU at store level accurately and expand the range of issues you’re uncovering in stores, it’s not enough—or so we learned, the hard way.

In CB4’s nascent years, we began to notice an anomaly. As we walked the floors with executives whose retail workforce was using our technology, time and time again, operations executives would have a higher hit rate while using CB4 than their store associates. Hit rate is the number of recommendations where the user finds a problem divided by the number of recommendations to which a user responds. It represents the distinction between a user responding “no issue found” vs. a user identifying and solving an issue. The higher a store’s hit rate, the more issues the store is uncovering and resolving.

It may seem, at first, that the discrepancy is the result of a lack of transparency or accountability on the store’s side. Who would want to readily admit, via an app (no less), that they or their team made a mistake on the job? Sure, that point is valid. But, CB4 can also take this concern out of the equation simply by tracking how a SKU’s sales increase after a recommendation is deployed, regardless of the feedback the store provides.

More often, the fact that we saw operations executives enjoy higher hit rates than their store teams indicated an altogether different conclusion. That is, just because the app guides a store associate to the problem doesn’t mean the store associate will have the experience, expertise, or (perhaps) motivation to successfully uncover and fix it.

This isn’t to reflect poorly on retail store teams. Store personnel come from a wide range of professional backgrounds, with different experience and interests. A store’s best sales-closer may be its worst floor re-stocker. The types of problems that one store associate will uncover and respond to may go completely unnoticed by another.

How We Overcame the Final Obstacle with Machine Learning

We started using our patented machine learning algorithms to process the feedback store managers provided through our app. When we send recommendations, we prompt stores to tell us whether or not they successfully discovered an issue as a result of the recommendation. When they don’t find an issue, we learn just as much about how to help them as we do when they successfully resolve one.

Over time, CB4 uses machine learning to gain a deeper understanding of each store’s associates strengths. The solution learns which types of issues the store manager is more likely to be successful at resolving and which will lead to greater revenue gains. This effort led to significant improvement in the hit rate and store associates’ satisfaction across all retail chains using CB4. Equally important, as we retailers successfully resolved more issues, they better serve shoppers and improve overall customer experience.

Ready to learn more about how CB4 works in real retail environments? Check out this video featuring Barnes & Noble’s Executive Vice President; President, Digital, Bill Woods, discussing CB4’s impact on B&N’s store operations.