Last year, many shoppers found themselves turning to the web when they once would have turned to the mall. Online shopping surged during the pandemic. But now, with a new normal and new shopping trends on the horizon, retailers are getting ready for a “return to retail” as soon as this summer.

That means getting ready to open their doors with high hopes that customers will be itching to head back to stores. With a new normal on the horizon, retailers seeking to gain a stronghold after the pandemic are making bold bets on shopping trends. Here are the predictions they’re making about how people will shop and what they’ll shop for.

1. Consumers will keep it casual.

Retail took a nosedive when the COVID-19 virus arrived. However, stay-at-home orders across most of the country boosted a few categories – notably, sales of activewear and leisure apparel. In one of 2020’s biggest shopping trends, comfort became king for consumers seeking to kick back at home (and perhaps squeeze in a midday exercise break) but still look presentable for their Zoom meetings.

Nordstrom, for example, reported double-digit growth for sales for its Active category in the fourth quarter. And just in March, Kohl’s launched FLX, its new private label athleisure brand (pronounced “flex”), as part of its strategic mission to be “the retailer of choice for the active and casual lifestyle.”

Consumer appetite for casual clothing is likely to continue as more companies shift to a permanent work-from-home model and video conferences routinely replace in-person meetings. Today, activewear makes up 20% of Kohl’s sales, but the department store hopes to increase that number to 30% in the coming years. The company also plans to carry more athleisure wear from Eddie Bauer and other name brands.

2. Health & wellness will stay top-of-mind

Without much interruption from the outside world during the pandemic, consumers turned their attention inward and focused on their wellness. Demand for home exercise devices skyrocketed – sales of yoga equipment soared 154% – as retailers rushed to cash in on the sudden appetite for health and wellness products.

Nordstrom partnered with Tonal, a San Francisco-based maker of smart home gym and personal trainer devices. Plans call for 40 Tonal shops in Nordstrom locations across the U.S. The 50-square-foot concept lets customers try the fitness technology while browsing Nordstrom’s women’s activewear departments.

Meanwhile, athleisure behemoth Lululemon purchased Mirror, a home fitness startup based in New York, for $500 million. Mirror sells a $1,495 wall-mounted device that streams unlimited exercise classes for a $39 monthly subscription. The platform provides certified personal trainers and customized playlists and workouts.

3. Stores will continue to be omnichannel hubs

Retailers saw last year’s shift toward online sales as an opportunity to repurpose their stores into omnichannel hubs. Dick’s Sporting Goods and Best Buy were amongst the quickest to transform stores into micro-fulfillment centers that could quickly meet online demand. Given that eMarketer estimated ecommerce sales increased in 2020 by 27.6% worldwide, the strategy was smart.

But by late 2021, with the pandemic at bay, shoppers will get back to stores. A Morning Brew/Harris Poll survey found that 43% of shoppers plan to shop mostly in-store after pandemic restrictions are lifted. Meanwhile, just 24% say they’ll shop mostly online. 33% said they’re likely to shop in-store and online in equal measure. With numbers like these, retailers are planning to keep fulfilling online orders in-store, while welcoming shoppers back with open arms.

Customers shopping in store may still expect the convenience of the home delivery, curbside pickup, and BOPIS (buy online, pick up in-store) arrangements they used during the pandemic. As a result, Best Buy plans to remodel more than 200 stores that will fulfill e-commerce orders as well as provide a destination for in-store shopping. Other retailers, from Sephora to Aldi are making similar plans.

4.The push toward private label will be permanent

Private label products thrived during the pandemic due to higher quality, lower prices, and greater availability on store shelves when consumers found their usual brands out of stock.

Demand is expected to increase, especially as consumers who shopped these goods during the pandemic grow to prefer them over the brand-name products they bought before COVID-19. Nearly one-third of shoppers said they expect to buy more private label foods during the pandemic, according to FMI’s U.S. Grocery Shopper Trends COVID-19 Tracker survey. The survey found that 13% of shopper plan to buy “much more.”

There’s good indication this shopping behavior will have legs beyond the pandemic. A recent McKinsey & Co. consumer survey found that 40% of respondents who switched brands in the pandemic will likely continue purchase the new brand after the crisis.

That’s good news for Trader Joe’s, Costco, and other chain store giants that have cultivated a strong base for their private label products. Target’s also in on it. The retailers’ Good & Gather brand reached $2 billion in sales in 2020. In light of its success, Target launches Favorite Day this Spring. Favorite Day will sell “indulgences” for under $15 such as mocktails, premium ice cream, snack, and candy and is expected to be popular with consumers looking to treat themselves.

5. People will show up for the fun of it

Regardless of a retailer’s vertical, momentum out of the pandemic is key. Essential retailers, like grocers, who say a massive boom in sales thanks to the crisis are looking for ways to maintain market share when it ends. Meanwhile, non-essential retailers, like apparel-sellers, are determined to make up lost ground.

Remember that 43% of shoppers who shared that they plan to shop mostly in-store after the pandemic in Morning Brew/Harris Poll’s survey? Retailers across the spectrum

predict that post-pandemic consumers will visit physical stores as much for entertainment as they will for the product. To capitalize on this trend, stores will need to become destinations for human connection and discovery, with events, classes, and product demonstrations.

The most successful retailers are focused on providing an immersive experience in real time. Notables include Lululemon, whose locations aspire to create a fitness utopia with exercise classes and meditation spaces, and Sephora, which is bringing its interactive makeup stores to 200 Kohl’s locations.

Even online retailers are seeking to cash in on the in-store experience. Amazon is expanding footprint of Amazon Fresh grocery stores across the U.S. It hopes to delight shoppers with an elaborate prepared foods section with meals, snacks, and wine, as well as novel cashierless technology.

Conclusion

The COVID-19 virus has ushered in a period of rapid change for retailers. Consumers are shopping online more than ever, as retailers gear up for a “return to retail” as soon as this summer.

From beefing up their activewear and private label offerings to leveraging their brick-and-mortar stores as shopping destinations, smart retailers are not waiting until after the pandemic to invest in their futures. Predicting and accommodating consumer appetite will be key to their success.

—

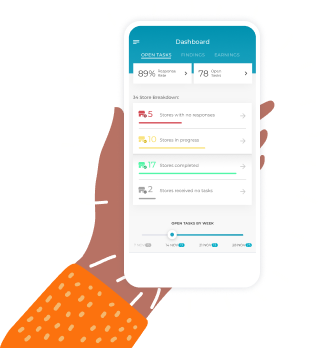

CB4 builds simple, revolutionary solutions that make the in-store experience easier and more rewarding for store teams and their shoppers. We send on-time, location-specific product-level recommendations each week at the speed stores need them rise to ever-changing demand and sell more product. Watch how it works.